Stretchable Electronics Manufacturing Industry Report 2025: Market Growth, Technology Advances, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Stretchable Electronics

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

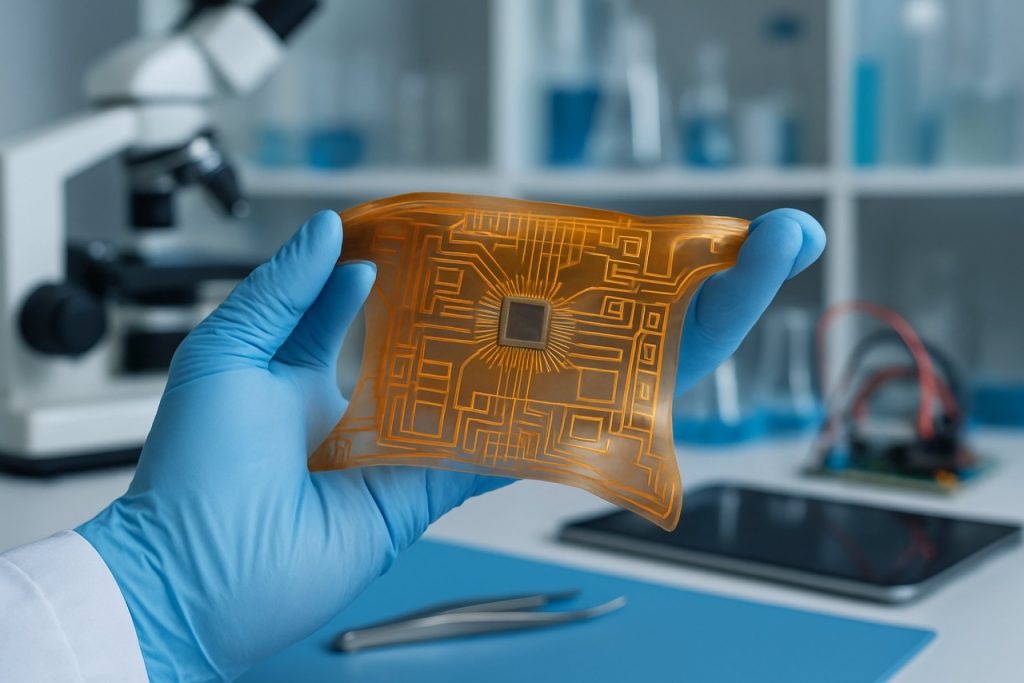

Stretchable electronics manufacturing refers to the production of electronic devices and components that maintain full functionality while being stretched, bent, or twisted. This technology is revolutionizing sectors such as healthcare, consumer electronics, automotive, and wearables by enabling the creation of flexible, conformable, and lightweight devices. As of 2025, the global stretchable electronics market is experiencing robust growth, driven by increasing demand for next-generation wearable devices, advancements in materials science, and the integration of electronics into textiles and medical devices.

According to recent market research, the stretchable electronics market is projected to reach a valuation of over USD 2.5 billion by 2025, growing at a compound annual growth rate (CAGR) exceeding 20% from 2020 to 2025. This growth is fueled by the proliferation of smart wearables, such as fitness trackers and health monitoring patches, which require flexible and durable electronic components. The healthcare sector, in particular, is a major adopter, leveraging stretchable sensors and circuits for continuous patient monitoring and minimally invasive diagnostics MarketsandMarkets.

Key players in the industry are investing heavily in research and development to improve the performance, reliability, and scalability of stretchable electronic materials and manufacturing processes. Innovations in conductive inks, stretchable substrates, and advanced printing techniques are enabling mass production and cost reduction, making these technologies more accessible for commercial applications. Companies such as DuPont, 3M, and ROHM Semiconductor are at the forefront, collaborating with startups and research institutions to accelerate product development and market adoption.

- Healthcare: Stretchable biosensors and electronic skin patches for real-time health monitoring.

- Consumer Electronics: Flexible displays, smart clothing, and wearable devices.

- Automotive: Integration of stretchable lighting and sensor systems into vehicle interiors and exteriors.

Geographically, North America and Asia-Pacific are leading the market, supported by strong R&D ecosystems, high consumer adoption rates, and government initiatives promoting advanced manufacturing. The competitive landscape is characterized by strategic partnerships, patent filings, and the emergence of specialized startups focused on niche applications IDTechEx.

In summary, stretchable electronics manufacturing is poised for significant expansion in 2025, underpinned by technological innovation, cross-industry collaboration, and growing end-user demand for flexible, high-performance electronic solutions.

Key Technology Trends in Stretchable Electronics

Stretchable electronics manufacturing is undergoing rapid transformation in 2025, driven by advances in materials science, process engineering, and integration techniques. The core challenge in this sector is to produce electronic devices that maintain functionality under significant mechanical deformation, such as stretching, bending, and twisting. This has led to the adoption of novel materials and hybrid manufacturing processes that combine traditional semiconductor fabrication with flexible substrates and conductive inks.

One of the most significant trends is the use of intrinsically stretchable materials, such as elastomeric polymers embedded with conductive nanomaterials. These materials enable the creation of circuits that can endure repeated mechanical stress without loss of performance. Companies like DuPont and 3M are at the forefront, developing stretchable conductive inks and films that can be printed onto flexible substrates using roll-to-roll processing, a scalable method that supports high-volume production.

Another key trend is the integration of microfabrication techniques, such as photolithography and laser patterning, with additive manufacturing. This hybrid approach allows for the precise placement of electronic components on stretchable substrates, improving device reliability and performance. For example, Xenon Corporation has pioneered photonic curing systems that rapidly sinter conductive inks without damaging heat-sensitive substrates, enabling faster and more energy-efficient production lines.

In 2025, there is also a growing emphasis on system-level integration, where sensors, power sources, and communication modules are embedded within a single stretchable platform. This is particularly relevant for applications in wearable health monitoring and soft robotics. Samsung Electronics and LG Electronics have both announced prototypes of stretchable displays and skin-like sensors, leveraging advanced encapsulation techniques to protect delicate circuits from environmental factors.

Finally, sustainability is becoming a priority in stretchable electronics manufacturing. Companies are exploring biodegradable substrates and recyclable conductive materials to reduce environmental impact. According to a 2024 report by IDTechEx, the adoption of eco-friendly materials and processes is expected to accelerate, driven by regulatory pressures and consumer demand for greener electronics.

Competitive Landscape and Leading Players

The competitive landscape of the stretchable electronics manufacturing sector in 2025 is characterized by a dynamic mix of established electronics giants, specialized material innovators, and agile startups. The market is driven by rapid advancements in flexible substrates, conductive inks, and integration techniques, with applications spanning healthcare wearables, soft robotics, smart textiles, and next-generation consumer electronics.

Key players dominating the stretchable electronics manufacturing space include Samsung Electronics, which leverages its expertise in flexible displays and advanced semiconductor processes to develop stretchable sensors and display prototypes. LG Electronics is also a significant contender, focusing on stretchable OLED panels and integrating these into wearable and automotive applications. Both companies invest heavily in R&D and strategic partnerships to maintain their technological edge.

Material innovation is a critical differentiator, with companies like DuPont and 3M leading in the development of stretchable conductive inks, elastomers, and adhesives. Their proprietary materials enable higher durability and conductivity, which are essential for commercial-scale manufacturing of stretchable circuits and sensors. These firms often collaborate with device manufacturers to co-develop application-specific solutions.

Startups and university spin-offs are also shaping the competitive landscape. For example, MC10 specializes in biocompatible, stretchable electronic patches for medical monitoring, while Xenomatix and NextFlex focus on automotive and industrial applications, respectively. These companies often secure funding through venture capital and government grants, enabling rapid prototyping and commercialization of novel stretchable devices.

Strategic collaborations and licensing agreements are prevalent, as companies seek to combine expertise in materials science, microfabrication, and end-use application design. For instance, NextFlex, a public-private consortium, plays a pivotal role in fostering innovation by connecting manufacturers, research institutions, and government agencies to accelerate the adoption of flexible and stretchable electronics technologies.

According to a recent report by MarketsandMarkets, the competitive intensity is expected to increase as more players enter the market, attracted by the expanding use cases and the potential for high-margin products. Intellectual property (IP) portfolios, manufacturing scalability, and the ability to meet stringent reliability standards will be key factors determining market leadership in 2025 and beyond.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The stretchable electronics manufacturing market is poised for robust growth between 2025 and 2030, driven by increasing demand for flexible, wearable, and conformable electronic devices across healthcare, consumer electronics, automotive, and industrial sectors. According to projections by MarketsandMarkets, the global stretchable electronics market is expected to register a compound annual growth rate (CAGR) of approximately 25% during this period. This rapid expansion is underpinned by advancements in materials science, particularly in stretchable substrates and conductive inks, which are enabling new manufacturing processes and product designs.

Revenue forecasts indicate that the market, valued at around USD 800 million in 2024, could surpass USD 2.5 billion by 2030, reflecting both increased adoption and higher average selling prices for advanced stretchable components. The healthcare segment is anticipated to be a primary revenue driver, with applications such as electronic skin patches, smart bandages, and implantable devices gaining traction. IDTechEx highlights that medical and wellness applications will account for over 40% of total market revenue by 2030, as regulatory approvals and clinical validations accelerate commercialization.

In terms of volume, the number of stretchable electronic units shipped is projected to grow at a CAGR exceeding 30% from 2025 to 2030. This surge is attributed to the proliferation of low-cost, disposable sensors and wearables, particularly in emerging markets. The consumer electronics sector, including smart textiles and flexible displays, is expected to contribute significantly to shipment volumes, although average unit prices in this segment are likely to decline due to commoditization and scale efficiencies.

- Key growth drivers: Ongoing R&D investments, miniaturization of components, and integration with IoT platforms.

- Regional outlook: Asia-Pacific is forecasted to lead both revenue and volume growth, supported by strong manufacturing ecosystems in China, South Korea, and Japan (Grand View Research).

- Challenges: High production costs, reliability concerns, and the need for scalable manufacturing processes remain barriers to mass adoption.

Overall, the 2025–2030 period will be characterized by rapid market expansion, technological innovation, and increasing mainstream adoption of stretchable electronics manufacturing solutions.

Regional Market Analysis: North America, Europe, Asia-Pacific & Rest of World

The global stretchable electronics manufacturing market is poised for significant growth in 2025, with regional dynamics shaped by technological innovation, investment patterns, and end-user adoption rates. North America, Europe, Asia-Pacific, and the Rest of the World (RoW) each present distinct opportunities and challenges for manufacturers and stakeholders.

North America remains a leader in stretchable electronics manufacturing, driven by robust R&D ecosystems and early adoption in healthcare, consumer electronics, and automotive sectors. The United States, in particular, benefits from strong university-industry collaborations and government funding, fostering innovation in wearable medical devices and flexible sensors. According to Grand View Research, North America accounted for a significant share of the global market in 2024, and this dominance is expected to continue in 2025 as companies like 3M and DuPont expand their product portfolios.

Europe is characterized by a strong focus on sustainability and regulatory compliance, which influences manufacturing processes and material selection. The region’s emphasis on eco-friendly electronics and integration with the automotive and healthcare industries is driving demand for stretchable components. Germany, France, and the UK are at the forefront, supported by EU-funded research initiatives and collaborations with leading universities. The European market is expected to see steady growth in 2025, particularly in medical wearables and smart textiles, as highlighted by MarketsandMarkets.

- Asia-Pacific is emerging as the fastest-growing region, propelled by large-scale manufacturing capabilities, cost advantages, and rapid adoption of consumer electronics. China, Japan, and South Korea are investing heavily in R&D and production infrastructure, with companies such as Samsung Electronics and LG Electronics leading the charge. The region’s growth is further supported by government initiatives to promote advanced manufacturing and the proliferation of smart devices, as noted by Fortune Business Insights.

- Rest of the World (RoW) includes Latin America, the Middle East, and Africa, where market penetration is currently limited but growing. Adoption is primarily driven by niche applications in healthcare and industrial monitoring. While infrastructure and investment levels lag behind other regions, increasing awareness and pilot projects are expected to stimulate gradual growth in 2025.

Overall, regional market dynamics in 2025 will be shaped by innovation ecosystems, regulatory environments, and sector-specific demand, with Asia-Pacific expected to outpace other regions in terms of growth rate, while North America and Europe maintain leadership in technological advancement and application diversity.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for stretchable electronics manufacturing in 2025 is marked by rapid expansion into new application domains and a surge in investment activity targeting both established players and innovative startups. As the technology matures, its integration into diverse sectors is accelerating, driven by advances in materials science, scalable fabrication techniques, and growing demand for flexible, conformable devices.

Emerging applications are particularly prominent in healthcare, where stretchable electronics enable next-generation wearable biosensors, smart bandages, and implantable devices that conform to the body’s contours for continuous, real-time monitoring. The global market for wearable medical devices is projected to surpass $30 billion by 2025, with stretchable electronics playing a pivotal role in this growth trajectory IDTechEx. Additionally, the integration of stretchable circuits into soft robotics and human-machine interfaces is opening new frontiers in assistive technologies and advanced prosthetics.

Consumer electronics is another hotspot, with stretchable displays, e-textiles, and skin-like input devices gaining traction. Major electronics manufacturers are investing in R&D to commercialize stretchable OLED displays and flexible sensors for next-generation smartphones, wearables, and augmented reality devices Samsung. The automotive sector is also exploring stretchable electronics for in-cabin health monitoring, adaptive lighting, and smart surfaces, reflecting a broader trend toward intelligent, responsive interiors Lux Research.

On the investment front, venture capital and corporate funding are flowing into startups specializing in novel stretchable substrates, printable conductive inks, and scalable roll-to-roll manufacturing processes. Strategic partnerships between material suppliers, device manufacturers, and end-users are accelerating commercialization timelines. Notably, Asia-Pacific—led by South Korea, Japan, and China—remains a focal point for both manufacturing scale-up and market adoption, while North America and Europe are hubs for innovation and early-stage investment Grand View Research.

Looking ahead, the convergence of stretchable electronics with artificial intelligence, energy harvesting, and wireless communication technologies is expected to unlock further applications in smart cities, personalized healthcare, and the Internet of Things. As manufacturing processes become more cost-effective and reliable, stretchable electronics are poised to transition from niche prototypes to mainstream commercial products by 2025 and beyond.

Challenges, Risks, and Strategic Opportunities

The manufacturing of stretchable electronics in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as the sector transitions from research-driven innovation to scalable commercial production. One of the primary challenges is the integration of advanced materials—such as stretchable conductors, elastomers, and hybrid composites—into reliable, high-throughput manufacturing processes. Achieving consistent quality and yield at scale remains difficult due to the sensitivity of these materials to environmental factors and mechanical stress during fabrication. This is compounded by the lack of standardized manufacturing protocols, which increases variability and complicates supply chain management.

Another significant risk is the high capital expenditure required for specialized equipment and cleanroom facilities. Many manufacturers must invest in custom roll-to-roll printing, laser patterning, and microfabrication technologies, which can strain financial resources, especially for startups and SMEs. Additionally, intellectual property (IP) risks are prevalent, as the field is crowded with overlapping patents and proprietary processes, leading to potential litigation and barriers to market entry. Regulatory uncertainty, particularly regarding biocompatibility and safety for medical and wearable applications, further complicates commercialization timelines and increases compliance costs.

Despite these hurdles, strategic opportunities abound. The growing demand for wearable health monitors, soft robotics, and smart textiles is driving investment and partnership activity. Companies that can develop robust, scalable manufacturing platforms stand to capture significant market share as adoption accelerates. Strategic collaborations between material suppliers, device manufacturers, and end-users are emerging as a key pathway to overcome technical bottlenecks and accelerate time-to-market. For example, partnerships between leading research institutions and industry players are facilitating the transfer of lab-scale innovations to pilot and full-scale production lines (IDTechEx).

- Investing in automation and in-line quality control systems can mitigate yield losses and improve process reliability.

- Developing modular manufacturing platforms allows for rapid adaptation to new device architectures and application requirements.

- Engaging with regulatory bodies early in the development process can streamline certification and market access, particularly in healthcare and consumer electronics sectors.

In summary, while the path to mass production of stretchable electronics is fraught with technical and commercial risks, companies that proactively address manufacturing challenges and leverage strategic partnerships are well-positioned to capitalize on the sector’s rapid growth in 2025 and beyond (MarketsandMarkets).

Sources & References

- MarketsandMarkets

- DuPont

- ROHM Semiconductor

- IDTechEx

- LG Electronics

- MC10

- Xenomatix

- NextFlex

- Grand View Research

- Fortune Business Insights

- Lux Research