Quantum-Limited Metrology Industry Report 2025: Market Dynamics, Technology Innovations, and Strategic Forecasts. Explore Key Growth Drivers, Regional Trends, and Competitive Insights Shaping the Next Five Years.

- Executive Summary & Market Overview

- Key Technology Trends in Quantum-Limited Metrology

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Quantum-limited metrology refers to measurement techniques and instrumentation that operate at or near the fundamental limits imposed by quantum mechanics, such as the Heisenberg uncertainty principle. These methods enable unprecedented precision in measuring physical quantities like time, frequency, magnetic fields, and gravitational waves. As of 2025, the quantum-limited metrology market is experiencing robust growth, driven by advances in quantum technologies, increased investment in quantum research, and expanding applications across sectors including telecommunications, healthcare, defense, and fundamental science.

According to International Data Corporation (IDC), global spending on quantum technologies, including quantum-limited metrology, is projected to surpass $2.5 billion in 2025, with a compound annual growth rate (CAGR) exceeding 20% from 2022 to 2025. The market is characterized by rapid innovation, with leading players such as Thorlabs, National Institute of Standards and Technology (NIST), and Oxford Instruments investing heavily in R&D to push the boundaries of measurement sensitivity and accuracy.

Key drivers for the market include the demand for ultra-precise atomic clocks in global navigation satellite systems (GNSS), quantum sensors for medical imaging and diagnostics, and quantum-enhanced measurement devices for materials science and semiconductor manufacturing. The integration of quantum-limited metrology with photonics and cryogenics is also opening new avenues for commercialization, particularly in the development of quantum computers and secure communication networks.

- Regional Trends: North America and Europe lead the market, supported by strong government funding and established research infrastructure. Asia-Pacific is rapidly catching up, with significant investments from China and Japan in quantum research and industrial applications (McKinsey & Company).

- Challenges: The market faces hurdles such as high costs, technical complexity, and the need for specialized talent. Standardization and interoperability remain ongoing concerns as the technology matures.

- Outlook: The quantum-limited metrology market is expected to continue its upward trajectory, with breakthroughs in quantum error correction, miniaturization, and integration likely to expand its reach into new industries and applications (Boston Consulting Group).

In summary, quantum-limited metrology is transitioning from a niche scientific discipline to a cornerstone of next-generation measurement and sensing technologies, with significant implications for both industry and society in 2025 and beyond.

Key Technology Trends in Quantum-Limited Metrology

Quantum-limited metrology refers to measurement techniques that approach or reach the fundamental sensitivity limits imposed by quantum mechanics, such as the Heisenberg uncertainty principle. In 2025, the field is witnessing rapid technological advancements, driven by the need for ultra-precise measurements in sectors like quantum computing, navigation, and fundamental physics research.

One of the most significant trends is the integration of squeezed light sources into optical metrology systems. Squeezed states of light reduce quantum noise below the standard quantum limit, enabling enhanced sensitivity in applications such as gravitational wave detection and atomic clocks. For instance, the LIGO Laboratory has successfully implemented squeezed light to improve the detection of gravitational waves, setting a precedent for broader adoption in other high-precision measurement systems.

Another key trend is the deployment of entangled photon and atom states to surpass classical measurement limits. Quantum entanglement allows for correlated measurements that can achieve sensitivities at the so-called Heisenberg limit, which is unattainable with classical resources. This approach is being actively explored in quantum-enhanced magnetometry and interferometry, with research institutions such as NIST and Max Planck Institute for the Science of Light leading experimental demonstrations.

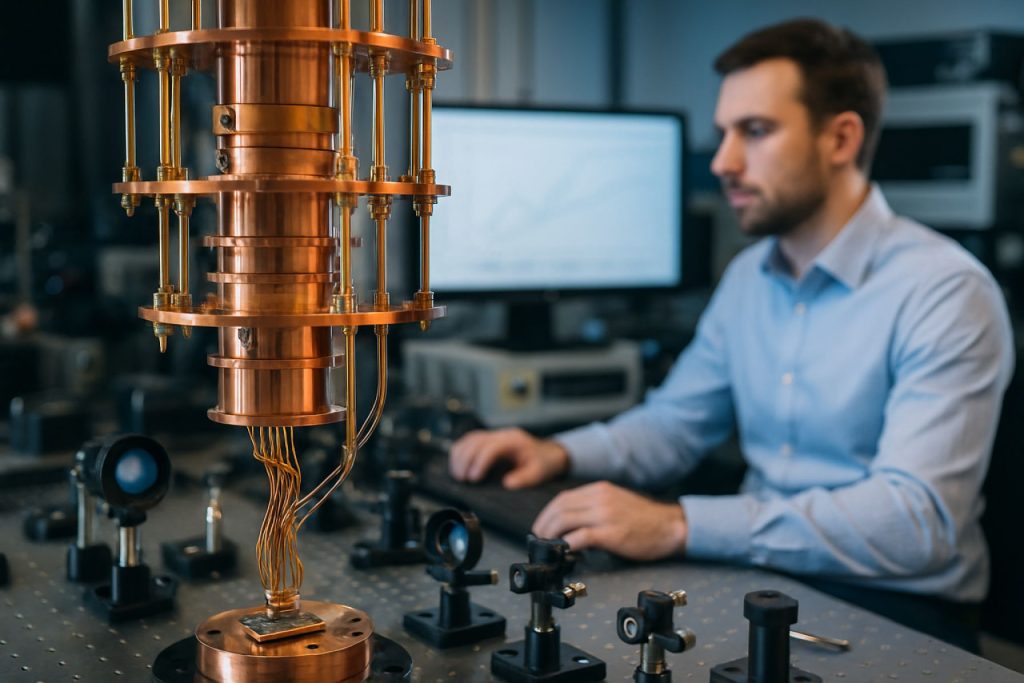

Advancements in superconducting quantum circuits are also shaping the landscape of quantum-limited metrology. These circuits, which form the backbone of many quantum computers, are now being adapted for use in ultra-sensitive microwave and radio-frequency measurements. Companies like IBM Quantum and Rigetti Computing are at the forefront of developing scalable quantum devices that can be repurposed for metrological applications.

Additionally, the miniaturization and integration of quantum sensors onto photonic and electronic chips is enabling the deployment of quantum-limited metrology in real-world environments. This trend is supported by investments from both public and private sectors, with organizations such as the European Quantum Industry Consortium fostering collaboration between academia and industry to accelerate commercialization.

In summary, 2025 is marked by the convergence of quantum optics, superconducting technologies, and integrated photonics, all pushing the boundaries of measurement sensitivity. These trends are expected to unlock new capabilities in scientific discovery, industrial quality control, and next-generation navigation systems.

Competitive Landscape and Leading Players

The competitive landscape of the quantum-limited metrology market in 2025 is characterized by a dynamic interplay between established technology conglomerates, specialized quantum startups, and research-driven institutions. The sector is witnessing rapid innovation, with companies racing to commercialize quantum-enhanced measurement solutions for applications in precision sensing, timekeeping, navigation, and fundamental physics research.

Leading players in this space include IBM, which leverages its quantum computing expertise to develop advanced quantum sensors and metrology platforms. Thales Group is another major contender, focusing on quantum-limited gyroscopes and gravimeters for defense and aerospace applications. Qnami, a Swiss startup, has gained traction with its quantum diamond-based scanning probe microscopes, enabling nanoscale magnetic imaging with unprecedented sensitivity.

In the United States, Lockheed Martin and National Institute of Standards and Technology (NIST) are at the forefront of integrating quantum-limited metrology into navigation and timing systems, particularly for GPS-denied environments. Meanwhile, TOPTICA Photonics and Menlo Systems in Europe are recognized for their ultra-stable lasers and frequency combs, which are foundational to quantum-limited measurement systems.

The competitive environment is further shaped by strategic partnerships and government-backed initiatives. For instance, the European Quantum Communication Infrastructure (EuroQCI) project is fostering collaboration among industry leaders and research institutions to accelerate the deployment of quantum metrology in secure communications and infrastructure monitoring.

- IDTechEx projects that the quantum sensing and metrology market will surpass $1.2 billion by 2025, with a compound annual growth rate (CAGR) exceeding 20%.

- Startups such as MagiQ Technologies and QuSpin are attracting significant venture capital, focusing on miniaturized quantum sensors for medical imaging and geophysical exploration.

Overall, the 2025 quantum-limited metrology market is marked by intense R&D activity, cross-sector alliances, and a clear trend toward commercialization, with both established and emerging players vying for leadership in this transformative field.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The quantum-limited metrology market is poised for robust expansion between 2025 and 2030, driven by accelerating investments in quantum technologies, heightened demand for ultra-precise measurement solutions, and the proliferation of quantum-enabled devices across sectors such as semiconductors, healthcare, and advanced manufacturing. According to projections by IDTechEx, the global quantum technologies market—which includes quantum-limited metrology—will experience a compound annual growth rate (CAGR) exceeding 25% during this period, with metrology applications representing a significant and rapidly growing segment.

Revenue forecasts for quantum-limited metrology specifically are expected to surpass $1.2 billion by 2030, up from an estimated $320 million in 2025, reflecting a CAGR of approximately 30% over the forecast period. This surge is attributed to the increasing adoption of quantum sensors and measurement systems in high-value industries, where even marginal improvements in precision can yield substantial operational and financial benefits. For instance, the semiconductor industry’s transition to sub-5nm process nodes is fueling demand for quantum-limited metrology tools capable of atomic-scale resolution, as highlighted by Semiconductor Industry Association reports.

Volume analysis indicates a parallel rise in the deployment of quantum-limited metrology devices. The annual shipment of quantum-enabled sensors and measurement instruments is projected to grow from approximately 5,000 units in 2025 to over 30,000 units by 2030, according to data from MarketsandMarkets. This growth is particularly pronounced in regions with strong government and private sector support for quantum research, such as North America, Europe, and parts of Asia-Pacific.

- Key growth drivers: Increased R&D funding, strategic partnerships between quantum technology firms and end-user industries, and the integration of quantum metrology in next-generation manufacturing and healthcare diagnostics.

- Challenges: High initial costs, technical complexity, and the need for specialized talent may temper the pace of adoption in some sectors.

Overall, the 2025–2030 period is expected to mark a transformative phase for quantum-limited metrology, with both revenue and unit volumes scaling rapidly as the technology matures and its value proposition becomes increasingly evident across critical industries.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for quantum-limited metrology in 2025 reflects a dynamic interplay of research intensity, industrial adoption, and governmental support across North America, Europe, Asia-Pacific, and the Rest of World. Each region demonstrates unique strengths and faces distinct challenges in advancing quantum-limited measurement technologies.

- North America: The United States and Canada remain at the forefront, driven by robust investments in quantum research and a strong ecosystem of academic institutions and technology companies. The U.S. National Quantum Initiative Act and funding from agencies such as the National Institute of Standards and Technology (NIST) have accelerated the development and commercialization of quantum-limited metrology tools, particularly for applications in semiconductor manufacturing, defense, and fundamental physics. The presence of leading firms and startups, as well as collaborations with national laboratories, further cements North America’s leadership.

- Europe: Europe’s quantum-limited metrology market is characterized by coordinated public-private partnerships and cross-border research initiatives, notably under the Quantum Flagship program. Countries such as Germany, the UK, and France are investing heavily in quantum sensors and standards, with a focus on precision measurement for healthcare, navigation, and environmental monitoring. The Physikalisch-Technische Bundesanstalt (PTB) and other national metrology institutes play a pivotal role in setting standards and fostering innovation.

- Asia-Pacific: The Asia-Pacific region, led by China, Japan, and South Korea, is rapidly scaling up its quantum-limited metrology capabilities. China’s government-backed initiatives and significant R&D spending have resulted in breakthroughs in quantum communication and sensing, with institutions like the Chinese Academy of Sciences at the helm. Japan’s focus on quantum-enhanced imaging and South Korea’s investments in quantum cryptography and measurement technologies are also noteworthy. The region benefits from strong manufacturing bases and increasing collaboration between academia and industry.

- Rest of World: While adoption is slower in other regions, countries such as Australia and Israel are emerging as innovation hubs, leveraging targeted government funding and international partnerships. Australia’s National Quantum Strategy and Israel’s focus on quantum sensing for defense and cybersecurity are driving niche advancements.

Overall, the global quantum-limited metrology market in 2025 is marked by regional specialization, with North America and Europe leading in foundational research and standardization, Asia-Pacific excelling in rapid commercialization, and the Rest of World contributing through focused innovation and strategic alliances.

Future Outlook: Emerging Applications and Investment Hotspots

Quantum-limited metrology, which leverages quantum phenomena such as entanglement and squeezing to surpass classical measurement limits, is poised for significant breakthroughs and commercialization by 2025. The future outlook for this field is shaped by both emerging applications and evolving investment landscapes, as quantum technologies transition from laboratory research to real-world deployment.

Emerging applications are rapidly diversifying beyond traditional domains like atomic clocks and gravitational wave detection. In 2025, quantum-limited sensors are expected to play a pivotal role in next-generation medical imaging, enabling non-invasive diagnostics with unprecedented sensitivity. For instance, quantum-enhanced magnetometers are being developed for early-stage detection of neurological disorders, offering a leap in spatial and temporal resolution compared to classical devices. Similarly, quantum-limited interferometry is being integrated into semiconductor manufacturing for nanoscale process control, addressing the industry’s demand for ever-finer feature sizes and defect detection capabilities.

Another promising application area is environmental monitoring. Quantum-limited gravimeters and spectrometers are being deployed for subsurface resource exploration and atmospheric analysis, providing higher accuracy in detecting mineral deposits and greenhouse gas concentrations. These advancements are attracting attention from both energy companies and environmental agencies seeking to optimize resource management and regulatory compliance.

On the investment front, 2025 is witnessing a surge in venture capital and government funding targeting quantum-limited metrology startups and scale-ups. According to Boston Consulting Group, global private investment in quantum technologies exceeded $2.35 billion in 2023, with a growing share allocated to quantum sensing and metrology. Strategic partnerships between quantum hardware firms and end-user industries—such as healthcare, aerospace, and advanced manufacturing—are accelerating technology transfer and pilot deployments. Notably, the European Union’s Quantum Flagship program and the U.S. National Quantum Initiative are channeling substantial resources into metrology-focused R&D, fostering a robust innovation ecosystem (Quantum Flagship; National Quantum Initiative).

Investment hotspots are emerging in North America, Europe, and East Asia, where clusters of quantum startups, research institutions, and corporate partners are coalescing. Cities like Boston, Munich, and Tokyo are becoming focal points for talent and capital, supported by proactive government policies and cross-sector collaboration. As quantum-limited metrology matures, these regions are expected to lead in both technology commercialization and the creation of new market segments, setting the stage for a transformative impact across multiple industries by the end of the decade.

Challenges, Risks, and Strategic Opportunities

Quantum-limited metrology, which leverages quantum phenomena such as entanglement and squeezing to surpass classical measurement limits, is poised to revolutionize precision measurement across sectors like healthcare, navigation, and fundamental physics. However, the field faces significant challenges and risks that must be addressed to unlock its full strategic potential in 2025 and beyond.

One of the primary challenges is the extreme sensitivity of quantum systems to environmental noise and decoherence. Even minor thermal fluctuations or electromagnetic interference can degrade quantum states, limiting the practical deployment of quantum-enhanced sensors outside controlled laboratory settings. This necessitates robust error correction protocols and advanced isolation techniques, which can increase system complexity and cost (Nature Physics).

Scalability remains another critical hurdle. While proof-of-concept devices have demonstrated quantum advantage in metrology, scaling these systems for industrial or commercial use requires advances in quantum hardware, integration with classical electronics, and reliable manufacturing processes. The lack of standardized platforms and the bespoke nature of current quantum devices further complicate mass adoption (McKinsey & Company).

From a risk perspective, intellectual property (IP) and talent shortages are notable. The rapid pace of innovation has led to a fragmented IP landscape, with overlapping patents and potential for litigation. Additionally, the demand for quantum physicists and engineers far outstrips supply, creating bottlenecks in R&D and commercialization (Boston Consulting Group).

Despite these challenges, strategic opportunities abound. Quantum-limited metrology can enable breakthroughs in gravitational wave detection, medical imaging, and navigation systems immune to GPS spoofing. Governments and private investors are ramping up funding, with initiatives such as the EU’s Quantum Flagship and the US National Quantum Initiative providing substantial support for research and commercialization (European Commission, National Quantum Initiative).

- Collaborative partnerships between academia, industry, and government can accelerate technology transfer and standardization.

- Developing hybrid quantum-classical systems may offer a pragmatic path to early market entry.

- Focusing on niche, high-value applications—such as defense or pharmaceuticals—can provide near-term commercial traction while broader markets mature.

In summary, while quantum-limited metrology faces formidable technical and market risks, targeted strategies and cross-sector collaboration can unlock transformative opportunities in 2025 and beyond.

Sources & References

- International Data Corporation (IDC)

- Thorlabs

- National Institute of Standards and Technology (NIST)

- Oxford Instruments

- McKinsey & Company

- LIGO Laboratory

- Max Planck Institute for the Science of Light

- IBM Quantum

- Rigetti Computing

- Thales Group

- Qnami

- Lockheed Martin

- TOPTICA Photonics

- Menlo Systems

- IDTechEx

- MagiQ Technologies

- QuSpin

- Semiconductor Industry Association

- MarketsandMarkets

- Quantum Flagship

- Physikalisch-Technische Bundesanstalt (PTB)

- Chinese Academy of Sciences

- Nature Physics

- European Commission