Neutron Radiography Instrumentation Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Market Size, Competitive Dynamics, and Future Trends Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Neutron Radiography Instrumentation

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Challenges, Risks, and Emerging Opportunities

- Future Outlook: Strategic Recommendations and Investment Insights

- Sources & References

Executive Summary & Market Overview

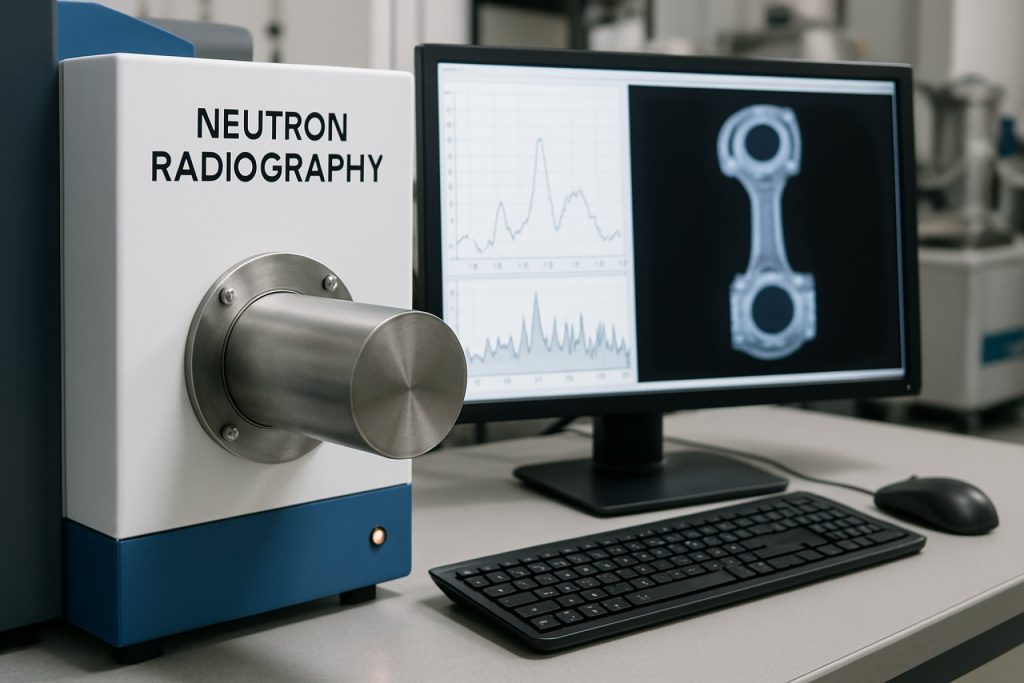

Neutron radiography instrumentation refers to the suite of devices and systems used to perform neutron radiography—a non-destructive imaging technique that leverages neutron beams to visualize the internal structure of objects. Unlike X-rays, neutrons interact differently with materials, making this technology particularly valuable for inspecting components with low atomic number elements (such as hydrogen in water or organic materials) and for applications where traditional radiography falls short. As of 2025, the global neutron radiography instrumentation market is experiencing steady growth, driven by advancements in nuclear research, aerospace, defense, and industrial quality assurance.

The market is characterized by a limited but highly specialized set of manufacturers and research institutions, with significant investments in upgrading neutron sources, detectors, and imaging systems. The increasing demand for high-resolution, real-time imaging in sectors such as aerospace—where the integrity of turbine blades and composite materials is critical—has spurred innovation in digital neutron imaging and automated analysis systems. Additionally, the expansion of nuclear power generation and the need for rigorous inspection of fuel rods and reactor components are contributing to market momentum.

According to recent analyses, the neutron radiography instrumentation market is projected to grow at a compound annual growth rate (CAGR) of approximately 6-8% through 2025, with North America and Europe leading in terms of installed capacity and research activity. Key players include specialized instrumentation firms and research organizations such as Helmholtz-Zentrum Berlin, National Institute of Standards and Technology (NIST), and International Atomic Energy Agency (IAEA), which support both commercial and academic applications.

- Drivers: Growing demand for advanced non-destructive testing (NDT) in aerospace and defense, increased investment in nuclear research infrastructure, and technological advancements in digital neutron imaging.

- Challenges: High capital costs, limited availability of neutron sources, and stringent regulatory requirements for radiation safety.

- Opportunities: Emerging applications in additive manufacturing, cultural heritage preservation, and battery research, as well as the development of compact neutron sources for decentralized imaging.

In summary, neutron radiography instrumentation is poised for moderate but sustained growth in 2025, underpinned by its unique imaging capabilities and expanding application base. The market’s trajectory will depend on continued innovation, regulatory support, and the ability to address cost and accessibility barriers.

Key Technology Trends in Neutron Radiography Instrumentation

Neutron radiography instrumentation is undergoing significant technological advancements as the demand for high-resolution, non-destructive testing (NDT) grows across industries such as aerospace, automotive, nuclear energy, and defense. In 2025, several key technology trends are shaping the evolution of neutron radiography systems, focusing on improved imaging capabilities, automation, and integration with digital workflows.

- Digital Detector Advancements: The transition from traditional film-based detectors to advanced digital detectors is accelerating. Modern neutron imaging systems now employ scintillator-based flat panel detectors and complementary metal-oxide-semiconductor (CMOS) sensors, which offer higher spatial resolution, faster image acquisition, and real-time imaging capabilities. These improvements enable more precise defect detection and facilitate integration with automated inspection lines (International Atomic Energy Agency).

- Enhanced Source Technology: Compact accelerator-driven neutron sources and high-flux research reactors are being optimized for greater reliability and safety. These sources provide higher neutron flux, which reduces exposure times and increases throughput. The development of portable neutron generators is also expanding the applicability of neutron radiography to field inspections and remote locations (National Institute of Standards and Technology).

- Automated Image Processing and AI Integration: Artificial intelligence (AI) and machine learning algorithms are increasingly used to automate image analysis, defect recognition, and data interpretation. This reduces human error, speeds up inspection processes, and enables predictive maintenance strategies. AI-driven software platforms are being integrated with neutron radiography systems to provide real-time feedback and decision support (American Society for Nondestructive Testing).

- 3D Neutron Tomography: The adoption of computed tomography (CT) techniques in neutron radiography is enabling three-dimensional visualization of internal structures. This trend is particularly valuable for complex assemblies and additive manufacturing components, where internal features must be thoroughly inspected without disassembly (Elsevier).

- Integration with Digital Twins and Industry 4.0: Neutron radiography instrumentation is increasingly being linked with digital twin platforms and Industry 4.0 ecosystems. This integration allows for seamless data sharing, remote monitoring, and predictive analytics, enhancing asset management and lifecycle optimization (Siemens).

These technology trends are collectively driving the neutron radiography instrumentation market toward greater efficiency, accuracy, and versatility, positioning it as a critical tool for advanced industrial quality assurance in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the neutron radiography instrumentation market in 2025 is characterized by a concentrated group of specialized manufacturers, research institutions, and technology integrators. The market is driven by the increasing demand for non-destructive testing (NDT) solutions in sectors such as aerospace, defense, nuclear energy, and advanced manufacturing. Key players are distinguished by their technological expertise, proprietary detector technologies, and ability to deliver customized solutions for high-precision imaging.

Leading the market are established companies such as SCK CEN (Belgium), which operates the BR2 reactor and provides advanced neutron imaging services and instrumentation. Helmholtz-Zentrum Berlin (Germany) is another major player, offering state-of-the-art neutron radiography facilities and collaborating with industrial partners for instrument development. In the United States, National Institute of Standards and Technology (NIST) operates the NIST Center for Neutron Research, which is a hub for both research and commercial neutron imaging applications.

On the commercial side, Toshiba Energy Systems & Solutions Corporation (Japan) and Hitachi, Ltd. are prominent for their development of neutron radiography systems tailored for nuclear reactor maintenance and fuel inspection. Thermal Neutron Imaging, LLC (USA) is a notable private company specializing in portable neutron radiography systems for field applications, targeting aerospace and defense clients.

The market also features a number of innovative startups and university spin-offs, such as Paul Scherrer Institute (Switzerland), which is advancing digital neutron imaging technologies and collaborating with industry for commercialization. Strategic partnerships and joint ventures are common, as companies seek to leverage complementary expertise in detector materials, image processing software, and neutron source optimization.

- Technological differentiation is a key competitive factor, with players investing in higher resolution detectors, faster image acquisition, and improved safety features.

- Geographical proximity to research reactors or spallation sources remains a significant advantage, as access to high-flux neutron beams is essential for advanced applications.

- Regulatory compliance and adherence to international NDT standards are critical for market entry, especially in nuclear and aerospace sectors.

Overall, the neutron radiography instrumentation market in 2025 is defined by a blend of established scientific institutions and agile commercial entities, with competition centered on innovation, reliability, and application-specific customization.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The neutron radiography instrumentation market is poised for significant growth between 2025 and 2030, driven by expanding applications in aerospace, defense, nuclear energy, and advanced manufacturing. According to recent projections, the global market is expected to register a compound annual growth rate (CAGR) of approximately 7.2% during this period, with total revenues anticipated to reach $410 million by 2030, up from an estimated $290 million in 2025. This robust growth is underpinned by increasing investments in non-destructive testing (NDT) technologies and the rising demand for high-resolution imaging solutions in critical safety and quality assurance processes.

Volume-wise, the number of neutron radiography systems deployed worldwide is forecasted to grow from around 320 units in 2025 to over 480 units by 2030. This expansion is particularly notable in regions with strong nuclear research and industrial bases, such as North America, Europe, and parts of Asia-Pacific. The United States and Germany are expected to remain leading adopters, supported by government funding and the presence of established research institutions and industrial players.

Key market drivers include the modernization of aging nuclear infrastructure, the adoption of advanced materials in aerospace manufacturing, and the need for precise inspection of complex assemblies. The integration of digital imaging technologies and automation is also expected to enhance throughput and accuracy, further fueling market expansion. Additionally, the development of compact, transportable neutron sources is opening new opportunities for field-based and on-site inspections, broadening the addressable market.

On the revenue front, the market is characterized by a mix of high-value, low-volume sales, with instrumentation costs ranging from $500,000 to over $2 million per system, depending on configuration and capabilities. Service and maintenance contracts, as well as software upgrades, are expected to contribute an increasing share of recurring revenues for leading vendors.

Overall, the neutron radiography instrumentation market’s growth trajectory from 2025 to 2030 reflects both technological advancements and the expanding scope of applications across industries. Market participants such as Thermo Fisher Scientific, General Atomics, and Helmholtz-Zentrum Berlin are expected to play pivotal roles in shaping the competitive landscape and driving innovation in this specialized segment.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global neutron radiography instrumentation market in 2025 is characterized by distinct regional dynamics, shaped by technological adoption, regulatory frameworks, and sectoral demand. The four primary regions—North America, Europe, Asia-Pacific, and Rest of World—exhibit varying growth trajectories and investment patterns.

- North America: North America remains a leading market, driven by robust investments in aerospace, defense, and nuclear energy sectors. The United States, in particular, benefits from established research institutions and government-backed initiatives supporting non-destructive testing (NDT) technologies. The presence of major industry players and collaborations with national laboratories, such as those under the U.S. Department of Energy, foster innovation and early adoption of advanced neutron radiography systems. The region’s stringent safety and quality standards further propel demand for high-precision instrumentation.

- Europe: Europe’s neutron radiography instrumentation market is underpinned by strong regulatory oversight and a focus on industrial quality assurance. Countries like Germany, France, and the UK are at the forefront, leveraging neutron imaging for automotive, aerospace, and nuclear decommissioning applications. The European Union’s emphasis on research and innovation, exemplified by funding through Horizon Europe, supports the development and deployment of next-generation neutron radiography tools. Collaborative projects across national laboratories and universities further enhance regional capabilities.

- Asia-Pacific: The Asia-Pacific region is experiencing the fastest growth, fueled by expanding manufacturing bases and increasing investments in nuclear power infrastructure. Japan and China are notable contributors, with significant government funding for research and industrial applications. The region’s rapid industrialization and the need for advanced NDT solutions in sectors such as electronics, automotive, and energy drive market expansion. Strategic partnerships between local companies and international technology providers, as seen with organizations like Japan Atomic Energy Agency, accelerate technology transfer and adoption.

- Rest of World: In regions outside the major markets, adoption of neutron radiography instrumentation is more gradual, often limited by budget constraints and lower awareness. However, select countries in the Middle East and Latin America are investing in nuclear research and infrastructure, creating niche opportunities. International collaborations and technology transfer programs, often facilitated by agencies such as the International Atomic Energy Agency, play a pivotal role in market development.

Overall, while North America and Europe maintain technological leadership, Asia-Pacific’s rapid industrial growth is reshaping the competitive landscape, and emerging regions are gradually integrating neutron radiography instrumentation through global partnerships and targeted investments.

Challenges, Risks, and Emerging Opportunities

Neutron radiography instrumentation faces a complex landscape of challenges and risks in 2025, even as new opportunities emerge driven by technological innovation and shifting market demands. One of the primary challenges is the high cost and limited availability of neutron sources, particularly research reactors and spallation sources, which are essential for generating the neutron beams required for imaging. The decommissioning of aging reactors in Europe and North America has further constrained access, leading to increased competition among research institutions and industrial users International Atomic Energy Agency.

Another significant risk is regulatory uncertainty. Neutron radiography systems often require strict compliance with nuclear safety and radiation protection standards, which vary across regions and are subject to change. This can delay project timelines and increase operational costs for manufacturers and end-users U.S. Nuclear Regulatory Commission. Additionally, the specialized nature of neutron radiography limits the pool of skilled operators and maintenance personnel, creating a talent bottleneck that can hinder adoption and scalability.

Technical challenges persist as well. Achieving high spatial resolution and contrast in neutron imaging remains difficult, especially for dynamic or large-scale industrial applications. The integration of digital detectors and advanced data processing algorithms is still in its early stages, with ongoing research required to match the performance and user-friendliness of established X-ray systems National Institute of Standards and Technology.

Despite these hurdles, several emerging opportunities are reshaping the market. The growing demand for non-destructive testing in aerospace, automotive, and energy sectors is driving interest in neutron radiography’s unique capabilities, such as imaging light elements (e.g., hydrogen in fuel cells) and complex assemblies that are opaque to X-rays. The development of compact accelerator-based neutron sources promises to democratize access, enabling on-site inspections and reducing dependence on large-scale facilities Elsevier.

Furthermore, advances in detector technology, including scintillator-based and solid-state detectors, are improving image quality and operational efficiency. Collaborations between research institutions and industry players are accelerating the commercialization of portable and automated neutron radiography systems, opening new markets in civil infrastructure, security screening, and cultural heritage preservation International Atomic Energy Agency.

Future Outlook: Strategic Recommendations and Investment Insights

The future outlook for neutron radiography instrumentation in 2025 is shaped by technological advancements, evolving end-user requirements, and a growing emphasis on non-destructive testing (NDT) across critical industries. As the demand for high-resolution imaging of complex internal structures intensifies—particularly in aerospace, nuclear energy, and advanced manufacturing—market participants are poised to benefit from both organic growth and strategic investments.

Strategic Recommendations:

- Invest in Digitalization and Automation: The transition from analog to digital neutron radiography systems is accelerating, driven by the need for higher throughput, improved image quality, and seamless data integration. Companies should prioritize R&D in digital detector technologies and automated image analysis software to enhance operational efficiency and reduce human error. Partnerships with software developers and AI firms can further strengthen product offerings.

- Expand Application Verticals: While aerospace and nuclear sectors remain core markets, emerging opportunities exist in additive manufacturing, cultural heritage preservation, and battery research. Diversifying application portfolios can mitigate sector-specific risks and tap into new revenue streams. Targeted marketing and collaboration with research institutions can facilitate entry into these nascent segments.

- Enhance Regulatory Compliance and Safety: With increasing scrutiny on radiation safety and environmental impact, manufacturers should invest in compliance with evolving international standards such as ISO 19232 and ASTM E545. Proactive engagement with regulatory bodies and end-users will be critical to ensure product acceptance and market access.

- Geographic Expansion: Asia-Pacific, particularly China and India, is witnessing robust investments in nuclear infrastructure and advanced manufacturing, presenting significant growth potential. Establishing local partnerships, service centers, and training programs can accelerate market penetration in these regions.

Investment Insights:

- Rising R&D Expenditure: According to International Atomic Energy Agency, global R&D spending on neutron imaging technologies is expected to grow steadily, with public-private partnerships playing a pivotal role in innovation and commercialization.

- M&A Activity: The market is likely to see increased merger and acquisition activity as established players seek to acquire niche technology providers and expand their solution portfolios. Investors should monitor companies with proprietary detector technologies and strong intellectual property positions.

- Government Funding: National laboratories and defense agencies, such as the U.S. Department of Energy and NASA, continue to fund neutron radiography research, offering stable demand and partnership opportunities for instrument manufacturers.

In summary, the neutron radiography instrumentation market in 2025 is set for dynamic growth, underpinned by digital transformation, sectoral diversification, and global expansion. Strategic investments in technology, compliance, and partnerships will be key to capturing emerging opportunities and sustaining competitive advantage.

Sources & References

- Helmholtz-Zentrum Berlin

- National Institute of Standards and Technology (NIST)

- International Atomic Energy Agency (IAEA)

- American Society for Nondestructive Testing

- Elsevier

- Siemens

- Hitachi, Ltd.

- Paul Scherrer Institute

- Thermo Fisher Scientific

- General Atomics

- Horizon Europe

- Japan Atomic Energy Agency

- NASA