2025 Neutron Radiography Instrumentation Market Report: In-Depth Analysis of Growth Drivers, Technology Advances, and Global Opportunities. Explore Key Trends, Forecasts, and Competitive Insights Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Neutron Radiography Instrumentation

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

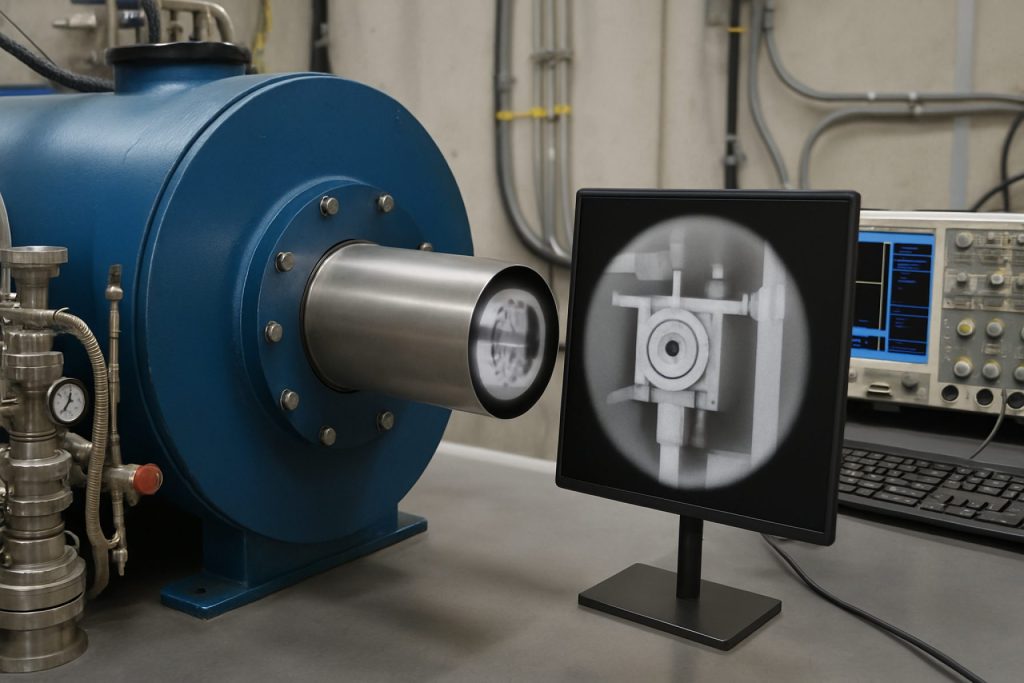

Neutron radiography instrumentation refers to the suite of devices and systems used to perform neutron radiography—a non-destructive imaging technique that leverages the unique interaction of neutrons with matter to visualize internal structures of objects. Unlike X-rays, neutrons are highly sensitive to light elements (such as hydrogen) and can penetrate heavy metals, making neutron radiography invaluable for industries such as aerospace, nuclear energy, defense, and advanced manufacturing.

As of 2025, the global market for neutron radiography instrumentation is experiencing steady growth, driven by increasing demand for advanced non-destructive testing (NDT) solutions. The market is characterized by the adoption of both reactor-based and accelerator-based neutron sources, with a notable shift towards compact accelerator-driven systems due to their operational flexibility and lower regulatory barriers. Key instrumentation includes neutron sources, collimators, detectors (such as scintillation screens and digital imaging plates), and sophisticated image processing software.

According to MarketsandMarkets, the broader NDT equipment market is projected to reach USD 24.3 billion by 2025, with neutron radiography representing a specialized but growing segment. The adoption of neutron radiography is particularly robust in regions with established nuclear research infrastructure, such as North America, Europe, and parts of Asia-Pacific. The United States Department of Energy and organizations like International Atomic Energy Agency (IAEA) continue to support research and deployment of neutron imaging facilities, further propelling market expansion.

Technological advancements are enhancing the resolution, speed, and automation of neutron radiography systems. The integration of digital imaging and real-time data analytics is enabling faster inspection cycles and more precise defect detection, which is critical for high-value applications in aerospace component validation and nuclear fuel inspection. Additionally, the emergence of portable neutron sources is opening new opportunities for field-based inspections, expanding the addressable market beyond traditional laboratory settings.

Despite these positive trends, the market faces challenges such as high initial capital investment, stringent regulatory requirements for neutron sources, and the need for specialized technical expertise. However, ongoing R&D and international collaborations are expected to mitigate these barriers, fostering broader adoption and innovation in neutron radiography instrumentation through 2025 and beyond.

Key Technology Trends in Neutron Radiography Instrumentation

Neutron radiography instrumentation is undergoing significant technological evolution as the demand for advanced non-destructive testing (NDT) solutions grows across industries such as aerospace, automotive, nuclear energy, and defense. In 2025, several key technology trends are shaping the development and deployment of neutron radiography systems, enhancing their resolution, efficiency, and applicability.

- Digital Detector Advancements: The transition from traditional film-based detection to digital imaging is accelerating. Modern neutron radiography systems increasingly employ high-resolution digital detectors, such as scintillator-based CCD and CMOS cameras, which offer superior image quality, faster acquisition times, and easier data integration. This shift enables real-time imaging and more precise defect characterization, as highlighted by International Atomic Energy Agency initiatives.

- Integration of Computed Tomography (CT): The fusion of neutron radiography with computed tomography (CT) is enabling three-dimensional visualization of internal structures. This trend is particularly valuable for complex assemblies and additive manufacturing components, where internal defects or material distributions must be mapped in detail. Leading research centers, such as Paul Scherrer Institute, are pioneering neutron CT systems that provide volumetric data with high spatial resolution.

- Enhanced Neutron Sources: Compact accelerator-driven neutron sources are gaining traction as alternatives to traditional nuclear reactors. These sources offer greater flexibility, lower regulatory hurdles, and improved safety profiles, making neutron radiography more accessible to industrial users. Companies like Thermo Fisher Scientific are investing in portable and modular neutron generators to expand market reach.

- Automation and AI Integration: Automation of image acquisition and analysis, powered by artificial intelligence (AI) and machine learning algorithms, is streamlining workflows and reducing operator dependency. AI-driven defect recognition and classification are improving inspection reliability and throughput, as reported by American Society for Nondestructive Testing.

- Hybrid Imaging Modalities: There is a growing trend toward integrating neutron radiography with complementary techniques such as X-ray imaging. Hybrid systems provide a more comprehensive assessment of materials, leveraging the unique sensitivity of neutrons to light elements and X-rays to heavy elements. This approach is being explored by institutions like National Institute of Standards and Technology.

These technology trends are collectively driving the evolution of neutron radiography instrumentation, making it more versatile, efficient, and aligned with the increasingly complex requirements of modern industry in 2025.

Competitive Landscape and Leading Players

The competitive landscape of the neutron radiography instrumentation market in 2025 is characterized by a mix of established scientific instrumentation firms, specialized nuclear technology providers, and emerging players leveraging advancements in neutron imaging. The market remains relatively niche due to the specialized nature of neutron radiography, which is primarily used in sectors such as aerospace, defense, nuclear energy, and advanced materials research.

Key players in this market include RIKEN, Helmholtz-Zentrum Berlin, and National Institute of Standards and Technology (NIST), all of which operate major neutron imaging facilities and contribute to the development of advanced instrumentation. These organizations often collaborate with equipment manufacturers and research consortia to push the boundaries of spatial resolution, detector sensitivity, and automation in neutron radiography systems.

On the commercial side, companies such as Toshiba Energy Systems & Solutions Corporation and Hitachi have developed neutron radiography solutions tailored for industrial non-destructive testing (NDT) applications, particularly for the inspection of turbine blades, fuel cells, and composite materials. These firms leverage their expertise in nuclear instrumentation and imaging to offer turnkey systems and custom solutions for research and quality assurance.

Emerging players and startups are also entering the market, focusing on portable neutron sources, digital detector arrays, and software for image reconstruction and analysis. For example, Thermo Fisher Scientific has expanded its portfolio to include neutron imaging detectors and supporting electronics, targeting both research and industrial clients.

- Collaborative research initiatives, such as those led by International Atomic Energy Agency (IAEA), foster technology transfer and standardization, further shaping the competitive dynamics.

- Geographically, Europe and Asia-Pacific dominate the market due to significant investments in nuclear research infrastructure and government-backed innovation programs.

- Barriers to entry remain high, given the regulatory requirements, technical complexity, and capital intensity associated with neutron source development and facility operation.

Overall, the neutron radiography instrumentation market in 2025 is defined by a blend of public research institutions, multinational conglomerates, and agile technology startups, each contributing to innovation and market expansion through specialized expertise and strategic partnerships.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global neutron radiography instrumentation market is projected to experience robust growth between 2025 and 2030, driven by increasing demand for advanced non-destructive testing (NDT) solutions across industries such as aerospace, defense, automotive, and energy. According to recent market analyses, the compound annual growth rate (CAGR) for neutron radiography instrumentation is expected to range between 7.5% and 9.2% during this period, reflecting both technological advancements and expanding application areas.

Revenue forecasts indicate that the market, valued at approximately USD 65 million in 2024, could surpass USD 110 million by 2030. This growth is underpinned by heightened investments in quality assurance and safety protocols, particularly in sectors where traditional X-ray or gamma-ray imaging is insufficient for detecting low atomic number materials or complex internal structures. The adoption of digital neutron imaging systems, which offer higher resolution and faster processing times, is also anticipated to accelerate market expansion.

Volume analysis suggests a steady increase in the number of neutron radiography systems deployed globally. In 2025, shipments are estimated to reach around 120–140 units, with annual volumes expected to grow at a CAGR of approximately 8% through 2030. This uptick is attributed to both the replacement of aging analog systems and the installation of new units in emerging markets, particularly in Asia-Pacific and Europe, where government and private sector initiatives are fostering the development of advanced NDT infrastructure.

Key market players, including SCK CEN, Helmholtz-Zentrum Berlin, and National Institute of Standards and Technology (NIST), are investing in R&D to enhance system sensitivity, automation, and integration with digital data management platforms. These innovations are expected to further drive adoption rates and open new revenue streams, particularly in high-value applications such as nuclear fuel inspection and aerospace component validation.

Overall, the neutron radiography instrumentation market is poised for significant expansion from 2025 to 2030, with strong revenue and volume growth supported by technological innovation, regulatory requirements, and the increasing complexity of industrial components requiring advanced inspection solutions.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global neutron radiography instrumentation market is witnessing differentiated growth patterns across key regions—North America, Europe, Asia-Pacific, and the Rest of the World—driven by varying levels of technological adoption, regulatory frameworks, and industrial demand.

North America remains a leading market, underpinned by robust investments in nuclear research, aerospace, and defense sectors. The United States, in particular, benefits from the presence of advanced research institutions and government-backed nuclear programs, fostering demand for high-precision neutron radiography systems. The region’s focus on non-destructive testing (NDT) for critical infrastructure and aerospace components further accelerates market growth. According to American Society for Nondestructive Testing, the adoption of neutron radiography in quality assurance processes is expected to rise steadily through 2025.

Europe is characterized by strong regulatory oversight and a mature nuclear energy sector, especially in countries like France, Germany, and the UK. The European market is also buoyed by collaborative research initiatives and funding from the European Union, which support the modernization of radiography instrumentation. The presence of established players and a focus on safety compliance drive the adoption of advanced neutron imaging technologies. As per CORDIS (European Commission), ongoing projects in nuclear safety and materials science are likely to sustain demand for neutron radiography instrumentation in the region.

Asia-Pacific is emerging as the fastest-growing market, propelled by rapid industrialization, expanding nuclear power programs, and increasing investments in scientific research. China, Japan, and South Korea are at the forefront, with government initiatives aimed at enhancing nuclear safety and infrastructure reliability. The region’s manufacturing boom, particularly in automotive and electronics, is also spurring the need for advanced NDT solutions. According to International Atomic Energy Agency (IAEA), Asia-Pacific’s share in global neutron radiography instrumentation sales is projected to increase significantly by 2025.

- Rest of the World (including Latin America, Middle East, and Africa) is experiencing gradual adoption, primarily in research institutions and select industrial applications. While market penetration remains limited due to budget constraints and lower awareness, international collaborations and technology transfer initiatives are expected to stimulate growth in the coming years.

Overall, regional dynamics in 2025 will be shaped by a combination of technological innovation, regulatory mandates, and sector-specific demand, with Asia-Pacific poised for the most rapid expansion in neutron radiography instrumentation.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for neutron radiography instrumentation in 2025 is shaped by a convergence of technological advancements, expanding application domains, and strategic investments. As industries increasingly demand non-destructive testing (NDT) solutions with higher sensitivity and resolution, neutron radiography is poised to complement or even surpass traditional X-ray methods in select sectors. The unique ability of neutrons to penetrate heavy metals while revealing light elements such as hydrogen makes neutron radiography indispensable for inspecting complex assemblies, fuel cells, and advanced composite materials.

Emerging applications are particularly prominent in the aerospace, automotive, and energy sectors. In aerospace, neutron radiography is being adopted for the inspection of turbine blades, detection of water ingress in honeycomb structures, and quality assurance of additive-manufactured components. The automotive industry is leveraging neutron imaging to analyze hydrogen fuel cells and battery systems, supporting the transition to electric and hydrogen-powered vehicles. In the energy sector, nuclear power plants and research reactors are utilizing neutron radiography for fuel inspection and structural integrity assessments, ensuring operational safety and regulatory compliance (International Atomic Energy Agency).

Medical and life sciences are also emerging as investment hotspots. Neutron radiography is being explored for imaging biological tissues, pharmaceuticals, and even archaeological artifacts, offering contrast mechanisms unavailable with conventional X-rays. The development of compact neutron sources and digital detector technologies is lowering the barrier to entry for research institutions and hospitals, broadening the market base (National Institute of Standards and Technology).

From an investment perspective, regions with robust nuclear research infrastructure—such as North America, Europe, and parts of Asia-Pacific—are leading in both public and private funding. Notably, government-backed initiatives in the United States and Europe are supporting the modernization of neutron imaging facilities and the commercialization of portable neutron radiography systems (European Commission). Venture capital is increasingly flowing into startups developing advanced detectors, image processing software, and compact neutron generators, signaling confidence in the sector’s growth potential.

- Expansion into hydrogen economy applications, including fuel cell and storage system inspection.

- Integration with artificial intelligence for automated defect recognition and real-time analysis.

- Development of mobile and modular neutron radiography units for field deployment.

Overall, 2025 is expected to witness accelerated adoption of neutron radiography instrumentation, driven by cross-sector innovation and targeted investments in emerging application areas.

Challenges, Risks, and Strategic Opportunities

Neutron radiography instrumentation faces a complex landscape of challenges and risks in 2025, but these also create avenues for strategic opportunities. One of the primary challenges is the high cost and limited availability of neutron sources, particularly research reactors and spallation sources, which are essential for generating the neutron beams required for imaging. The decommissioning of aging reactors in Europe and North America has further constrained access, leading to bottlenecks in both research and industrial applications International Atomic Energy Agency. This scarcity drives up operational costs and limits the scalability of neutron radiography services.

Another significant risk is the stringent regulatory environment governing the use of neutron sources. Compliance with safety, security, and environmental regulations increases the complexity and cost of deploying and maintaining neutron radiography systems. Additionally, the need for highly specialized personnel to operate and interpret neutron radiography equipment presents a talent bottleneck, as the pool of qualified experts remains limited National Institute of Standards and Technology.

Technological obsolescence is also a concern. Rapid advancements in alternative imaging modalities, such as high-resolution X-ray computed tomography and digital radiography, threaten to erode the competitive edge of neutron radiography, especially in sectors where its unique capabilities (e.g., imaging light elements in heavy matrices) are not strictly required MarketsandMarkets.

Despite these challenges, strategic opportunities are emerging. The development of compact accelerator-driven neutron sources offers the potential to decentralize neutron radiography, making it more accessible to a broader range of industries, including aerospace, automotive, and energy International Atomic Energy Agency. Advances in digital detectors and image processing algorithms are improving the resolution, speed, and automation of neutron imaging, reducing the need for specialized operators and expanding the range of feasible applications Elsevier.

- Collaborations between research institutions and industry players are fostering innovation in portable and modular neutron radiography systems.

- Growing demand for non-destructive testing in additive manufacturing and advanced materials is creating new market segments.

- Government funding and international partnerships are supporting the modernization of neutron facilities and the development of next-generation instrumentation.

In summary, while neutron radiography instrumentation in 2025 is constrained by source availability, regulatory hurdles, and competition from alternative technologies, strategic investments in compact sources, digitalization, and cross-sector partnerships are poised to unlock new growth opportunities.

Sources & References

- MarketsandMarkets

- International Atomic Energy Agency (IAEA)

- Paul Scherrer Institute

- Thermo Fisher Scientific

- American Society for Nondestructive Testing

- National Institute of Standards and Technology

- Helmholtz-Zentrum Berlin

- Hitachi

- CORDIS (European Commission)

- Elsevier