Expanded Polytetrafluoroethylene (ePTFE) Membrane Filtration Systems Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary & Market Overview

- Key Market Drivers and Restraints

- Technology Trends in ePTFE Membrane Filtration Systems

- Competitive Landscape and Leading Players

- Market Size & Growth Forecasts (2025–2030)

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Emerging Applications and End-User Insights

- Challenges, Risks, and Market Entry Barriers

- Opportunities and Future Outlook

- Sources & References

Executive Summary & Market Overview

Expanded Polytetrafluoroethylene (ePTFE) membrane filtration systems represent a critical segment within the global filtration market, renowned for their exceptional chemical resistance, high thermal stability, and superior filtration efficiency. ePTFE membranes are microporous materials derived from polytetrafluoroethylene, engineered through a unique expansion process that imparts a highly interconnected pore structure. This enables precise filtration of particulates, bacteria, and even viruses, making ePTFE membranes indispensable in industries such as pharmaceuticals, medical devices, water treatment, electronics, and industrial processing.

As of 2025, the global market for ePTFE membrane filtration systems is experiencing robust growth, driven by increasing regulatory standards for air and water quality, heightened demand for high-purity filtration in healthcare and electronics, and the ongoing expansion of industrial manufacturing. According to recent market analyses, the ePTFE membrane market is projected to achieve a compound annual growth rate (CAGR) of approximately 7-9% through 2028, with the filtration systems segment accounting for a significant share of this expansion MarketsandMarkets.

Key growth drivers include:

- Stringent Environmental Regulations: Governments worldwide are enforcing stricter emissions and water discharge standards, particularly in North America, Europe, and parts of Asia-Pacific. This is accelerating the adoption of advanced filtration technologies, including ePTFE membranes, in both municipal and industrial applications Grand View Research.

- Healthcare and Life Sciences: The COVID-19 pandemic underscored the importance of reliable filtration in medical devices, personal protective equipment (PPE), and pharmaceutical manufacturing. ePTFE’s biocompatibility and high filtration efficiency have made it a material of choice for critical healthcare applications Fortune Business Insights.

- Technological Advancements: Ongoing R&D is yielding thinner, more durable, and higher-performing ePTFE membranes, expanding their applicability in microelectronics, food & beverage, and energy sectors.

Regionally, Asia-Pacific is emerging as the fastest-growing market, fueled by rapid industrialization, urbanization, and investments in water infrastructure. Meanwhile, North America and Europe continue to lead in technological innovation and regulatory compliance.

In summary, the ePTFE membrane filtration systems market in 2025 is characterized by strong demand across diverse end-use sectors, ongoing innovation, and a favorable regulatory environment, positioning it for sustained growth in the coming years.

Key Market Drivers and Restraints

Expanded polytetrafluoroethylene (ePTFE) membrane filtration systems are experiencing dynamic market forces in 2025, shaped by a combination of robust drivers and notable restraints. The primary market driver is the increasing demand for high-performance filtration solutions across industries such as pharmaceuticals, medical devices, water treatment, and electronics. ePTFE membranes are prized for their exceptional chemical resistance, high thermal stability, and superior filtration efficiency, making them indispensable in applications requiring stringent contamination control and durability. The ongoing global emphasis on clean water and air, coupled with tightening environmental regulations, is further propelling adoption in municipal and industrial water treatment, as well as in air filtration for cleanrooms and HVAC systems MarketsandMarkets.

Another significant driver is the rapid expansion of the healthcare and pharmaceutical sectors, particularly in emerging economies. The COVID-19 pandemic has heightened awareness of infection control, boosting demand for ePTFE-based medical masks, protective apparel, and sterile filtration systems. Additionally, the electronics industry’s growth, especially in Asia-Pacific, is fueling the need for advanced filtration to maintain ultra-clean manufacturing environments Grand View Research.

On the technological front, ongoing innovations in membrane manufacturing—such as improved pore size control and enhanced mechanical properties—are expanding the range of applications and improving cost-effectiveness. These advancements are enabling manufacturers to tailor ePTFE membranes for specific end-user requirements, further driving market penetration Research and Markets.

However, the market faces several restraints. The high initial cost of ePTFE membrane filtration systems compared to conventional alternatives remains a significant barrier, particularly for price-sensitive sectors and developing regions. The complex manufacturing process and reliance on specialized raw materials contribute to elevated production costs. Additionally, the market is challenged by the presence of alternative membrane materials, such as polyvinylidene fluoride (PVDF) and polypropylene, which offer competitive performance at lower costs in certain applications Fortune Business Insights.

Supply chain disruptions and volatility in raw material prices, exacerbated by geopolitical tensions and global economic uncertainties, also pose risks to market stability. Despite these challenges, the long-term outlook for ePTFE membrane filtration systems remains positive, driven by regulatory trends and the ongoing need for advanced filtration solutions.

Technology Trends in ePTFE Membrane Filtration Systems

Expanded polytetrafluoroethylene (ePTFE) membrane filtration systems are experiencing significant technological advancements as the market heads into 2025. These systems, known for their exceptional chemical resistance, high porosity, and thermal stability, are increasingly being adopted across industries such as pharmaceuticals, water treatment, electronics, and healthcare. Several key technology trends are shaping the evolution and adoption of ePTFE membrane filtration systems.

- Nanostructured ePTFE Membranes: Manufacturers are leveraging nanotechnology to engineer ePTFE membranes with finer pore structures, enhancing filtration efficiency and selectivity. This trend is particularly prominent in applications requiring the removal of ultrafine particulates and microorganisms, such as in pharmaceutical and semiconductor manufacturing. The integration of nanostructures also improves the anti-fouling properties of the membranes, reducing maintenance costs and downtime (W. L. Gore & Associates).

- Hybrid and Composite Membranes: There is a growing focus on developing hybrid membranes that combine ePTFE with other materials, such as polyvinylidene fluoride (PVDF) or ceramic layers. These composites offer enhanced mechanical strength, broader chemical compatibility, and improved durability, making them suitable for harsh industrial environments and aggressive chemical processes (MarketsandMarkets).

- Smart and Functionalized Membranes: The integration of smart functionalities, such as self-cleaning surfaces and antimicrobial coatings, is gaining traction. These innovations help extend membrane lifespan and maintain high filtration performance, especially in medical and food processing applications where hygiene is critical (Membrane World).

- Energy-Efficient Filtration Systems: With sustainability becoming a central concern, manufacturers are designing ePTFE membrane systems that operate at lower pressures and require less energy. Advances in membrane structure and module design are enabling higher flux rates and reduced operational costs, aligning with global energy efficiency goals (Frost & Sullivan).

- Digitalization and Process Automation: The adoption of digital monitoring and control systems is enhancing the operational efficiency of ePTFE membrane filtration units. Real-time data analytics, predictive maintenance, and remote monitoring capabilities are being integrated to optimize performance and reduce unplanned downtime (Sartorius AG).

These technology trends are expected to drive the continued growth and diversification of ePTFE membrane filtration systems in 2025, enabling broader application scopes and improved operational efficiencies across multiple sectors.

Competitive Landscape and Leading Players

The competitive landscape of the expanded polytetrafluoroethylene (ePTFE) membrane filtration systems market in 2025 is characterized by the presence of several global and regional players, each leveraging proprietary technologies and strategic partnerships to strengthen their market positions. The market is moderately consolidated, with a few leading companies accounting for a significant share, while numerous smaller firms and new entrants focus on niche applications and regional markets.

Key players in the ePTFE membrane filtration systems sector include W. L. Gore & Associates, Mitsui Chemicals, Sartorius AG, Merck KGaA (through its Millipore division), and Pall Corporation (a Danaher company). These companies have established robust R&D capabilities, extensive distribution networks, and a broad product portfolio catering to diverse end-use industries such as pharmaceuticals, medical devices, water treatment, and electronics.

W. L. Gore & Associates remains a dominant force, credited with pioneering ePTFE technology and maintaining a strong intellectual property portfolio. The company’s focus on innovation and high-performance filtration solutions has enabled it to secure long-term contracts with major pharmaceutical and industrial clients. Mitsui Chemicals, leveraging its advanced materials expertise, has expanded its ePTFE membrane offerings, particularly in Asia-Pacific, where demand for high-purity filtration in electronics and healthcare is surging.

Sartorius AG and Merck KGaA are notable for their integration of ePTFE membranes into comprehensive filtration systems, targeting bioprocessing and laboratory applications. Their global reach and emphasis on regulatory compliance have made them preferred suppliers for multinational pharmaceutical manufacturers. Pall Corporation, meanwhile, continues to invest in product development and strategic acquisitions to enhance its presence in water and air filtration segments.

The competitive dynamics are further shaped by ongoing investments in automation, sustainability, and digitalization. Leading players are increasingly collaborating with OEMs and research institutions to develop next-generation ePTFE membranes with improved durability, permeability, and chemical resistance. Additionally, regional manufacturers in China and India are intensifying competition by offering cost-effective alternatives and expanding their export capabilities, challenging established brands in price-sensitive markets.

Overall, the 2025 market landscape for ePTFE membrane filtration systems is defined by technological innovation, strategic alliances, and a growing emphasis on customized solutions to address evolving regulatory and industry-specific requirements.

Market Size & Growth Forecasts (2025–2030)

The global market for Expanded Polytetrafluoroethylene (ePTFE) membrane filtration systems is poised for robust growth in 2025, driven by increasing demand across sectors such as pharmaceuticals, water treatment, medical devices, and industrial filtration. According to recent market analyses, the ePTFE membrane filtration systems market is projected to reach a valuation of approximately USD 1.2 billion in 2025, with a compound annual growth rate (CAGR) expected to range between 7% and 9% through 2030 MarketsandMarkets. This growth trajectory is underpinned by the superior chemical resistance, high thermal stability, and exceptional filtration efficiency of ePTFE membranes, which make them highly suitable for critical applications in both liquid and air filtration.

Regionally, Asia-Pacific is anticipated to dominate the market in 2025, accounting for over 40% of global demand, fueled by rapid industrialization, stringent environmental regulations, and expanding healthcare infrastructure in countries such as China, India, and Japan Grand View Research. North America and Europe are also significant contributors, with established pharmaceutical and water treatment industries driving steady adoption of ePTFE membrane filtration systems.

Key end-use industries propelling market expansion in 2025 include:

- Pharmaceuticals: Growing emphasis on sterile filtration and contamination control is boosting demand for ePTFE membranes in drug manufacturing and laboratory settings.

- Water & Wastewater Treatment: Increasing investments in advanced filtration technologies to meet regulatory standards are accelerating the deployment of ePTFE-based systems.

- Medical Devices: The biocompatibility and breathability of ePTFE membranes are driving their use in surgical implants, wound care, and protective medical equipment.

- Industrial Filtration: The need for high-performance filtration in electronics, food & beverage, and chemical processing is further supporting market growth.

Looking ahead, the market is expected to benefit from ongoing R&D efforts aimed at enhancing membrane durability, permeability, and cost-effectiveness. Strategic collaborations and capacity expansions by leading manufacturers are also likely to shape the competitive landscape in 2025 and beyond Research and Markets.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for Expanded Polytetrafluoroethylene (ePTFE) membrane filtration systems is witnessing differentiated growth patterns across key regions: North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Each region’s trajectory is shaped by its industrial base, regulatory environment, and end-user adoption rates.

North America remains a leading market, driven by robust demand from the medical, pharmaceutical, and industrial filtration sectors. The United States, in particular, benefits from stringent regulatory standards for air and water quality, which fuel the adoption of advanced filtration technologies. The presence of major manufacturers and ongoing investments in R&D further bolster market growth. According to Grand View Research, North America’s share is expected to remain significant through 2025, with healthcare and environmental applications as primary growth drivers.

Europe is characterized by strong environmental regulations and a mature industrial base. The European Union’s focus on sustainability and clean technologies has accelerated the uptake of ePTFE membrane filtration systems, especially in water treatment and automotive applications. Germany, France, and the UK are leading adopters, supported by government initiatives and a well-established manufacturing sector. MarketsandMarkets projects steady growth in Europe, with increasing investments in green infrastructure and air pollution control technologies.

Asia-Pacific is the fastest-growing region, propelled by rapid industrialization, urbanization, and expanding healthcare infrastructure. China, Japan, and South Korea are at the forefront, with China accounting for a substantial share due to its large-scale manufacturing and government-led environmental initiatives. The region’s growth is further supported by rising demand for high-performance filtration in electronics, pharmaceuticals, and food & beverage industries. Fortune Business Insights highlights that Asia-Pacific is expected to register the highest CAGR through 2025, outpacing other regions in both volume and value.

- Rest of the World (RoW) includes Latin America, the Middle East, and Africa. While these markets are relatively nascent, increasing awareness of environmental and health standards is driving gradual adoption. Growth is particularly notable in sectors such as oil & gas and water treatment, with countries like Brazil and the UAE investing in modern filtration infrastructure.

Overall, regional dynamics in the ePTFE membrane filtration systems market reflect a blend of regulatory pressures, industrial development, and technological adoption, with Asia-Pacific emerging as the most dynamic growth engine through 2025.

Emerging Applications and End-User Insights

Expanded polytetrafluoroethylene (ePTFE) membrane filtration systems are witnessing a surge in emerging applications across diverse industries, driven by their unique combination of chemical resistance, high porosity, and exceptional filtration efficiency. In 2025, the market is seeing notable expansion beyond traditional sectors such as medical devices and industrial filtration, with new end-user segments adopting ePTFE membranes for advanced performance requirements.

One of the most significant emerging applications is in the field of air and gas filtration, particularly for cleanroom environments, semiconductor manufacturing, and HVAC systems. The demand for ultra-fine particulate removal and stringent air quality standards is propelling the adoption of ePTFE membranes, which offer superior filtration at sub-micron levels while maintaining low pressure drops. According to MarketsandMarkets, the global air filtration market is expected to grow robustly, with ePTFE membranes capturing a larger share due to their durability and efficiency.

In the automotive sector, ePTFE membrane filtration systems are increasingly used in cabin air filters, fuel cell components, and battery venting applications. The shift toward electric vehicles (EVs) and the need for enhanced air quality and component protection are key drivers. Leading automotive suppliers such as W. L. Gore & Associates are innovating with ePTFE-based solutions to address moisture management and particulate filtration in EV battery packs and electronic modules.

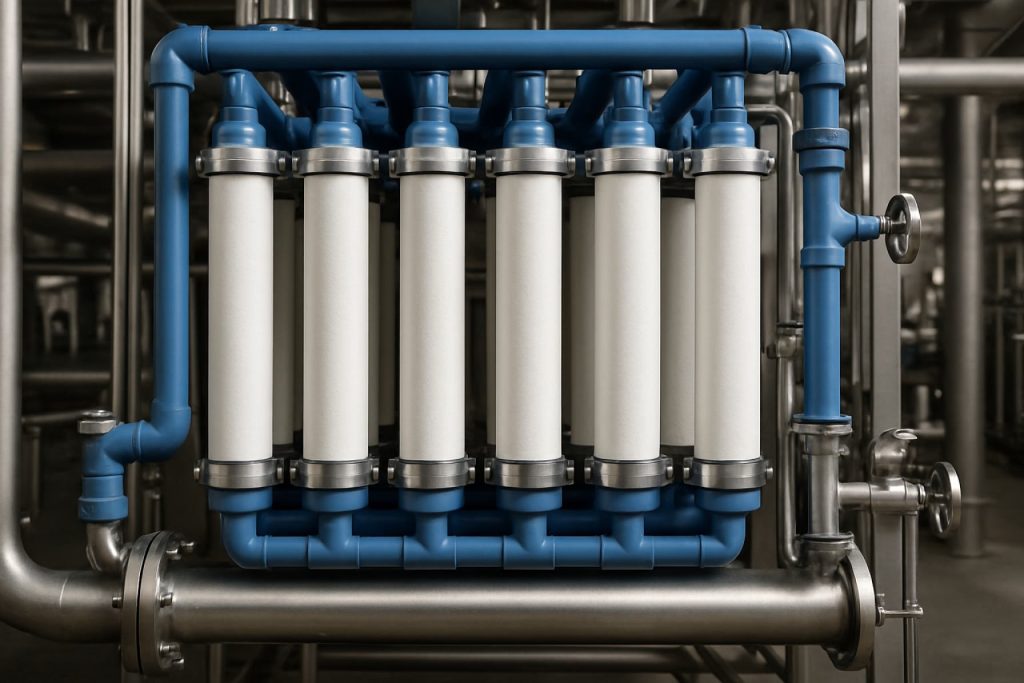

Water and wastewater treatment is another area where ePTFE membranes are gaining traction. Their hydrophobic and oleophobic properties make them ideal for membrane bioreactors (MBRs) and industrial water purification, especially in challenging environments with aggressive chemicals or high fouling potential. Recent pilot projects in Asia and Europe have demonstrated improved operational lifespans and reduced maintenance costs compared to conventional polymeric membranes, as reported by Frost & Sullivan.

From an end-user perspective, the healthcare and pharmaceutical industries continue to be major adopters, leveraging ePTFE membranes for sterile filtration, drug delivery devices, and implantable medical devices. The ongoing emphasis on infection control and regulatory compliance is expected to sustain demand in these sectors. Additionally, the electronics industry is exploring ePTFE membranes for moisture barriers and venting solutions in sensitive devices, as highlighted by IDTechEx.

Overall, 2025 is poised to see ePTFE membrane filtration systems penetrate new markets, with end-users prioritizing performance, reliability, and regulatory compliance. The trend toward miniaturization, sustainability, and advanced material integration is likely to further accelerate adoption across both established and emerging applications.

Challenges, Risks, and Market Entry Barriers

The market for expanded polytetrafluoroethylene (ePTFE) membrane filtration systems is poised for growth in 2025, but it faces a range of challenges, risks, and entry barriers that could impact new and existing players. One of the primary challenges is the high cost of raw materials and manufacturing processes. ePTFE membranes require specialized production techniques, including stretching and sintering, which demand significant capital investment and technical expertise. This creates a substantial barrier for new entrants, as established players benefit from economies of scale and proprietary know-how (W. L. Gore & Associates).

Intellectual property (IP) protection is another significant barrier. Leading manufacturers hold extensive patents covering both the material composition and the unique manufacturing processes of ePTFE membranes. This restricts the ability of new companies to enter the market without risking infringement litigation or the need for costly licensing agreements (MarketsandMarkets).

Regulatory compliance presents additional risks, especially in sectors such as medical devices, pharmaceuticals, and food processing, where ePTFE membranes are widely used. Companies must adhere to stringent standards set by agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). The certification process can be lengthy and expensive, delaying time-to-market and increasing operational costs (U.S. Food and Drug Administration).

Market acceptance and customer trust are also critical hurdles. End-users in industries such as healthcare, electronics, and industrial filtration often require extensive validation and long-term performance data before switching to new suppliers or technologies. This entrenched customer loyalty to established brands further raises the entry barrier for newcomers (Frost & Sullivan).

- Supply chain vulnerabilities: The ePTFE market is sensitive to disruptions in the supply of fluoropolymer resins, which are sourced from a limited number of global suppliers.

- Environmental and regulatory risks: Increasing scrutiny over perfluorinated compounds (PFCs) and their environmental impact could lead to tighter regulations, affecting production and marketability (U.S. Environmental Protection Agency).

- Technological obsolescence: Rapid advancements in alternative membrane technologies, such as ceramic or nanofiber membranes, pose a risk of substitution.

In summary, while the ePTFE membrane filtration systems market offers significant opportunities, it is characterized by high entry barriers, regulatory complexities, and evolving technological and environmental risks that must be carefully navigated by both incumbents and new entrants.

Opportunities and Future Outlook

The outlook for expanded polytetrafluoroethylene (ePTFE) membrane filtration systems in 2025 is marked by robust opportunities across multiple sectors, driven by increasing regulatory demands, technological advancements, and the growing need for high-performance filtration solutions. The unique properties of ePTFE membranes—such as exceptional chemical resistance, high thermal stability, and superior filtration efficiency—position them as a preferred choice in industries ranging from healthcare and pharmaceuticals to electronics, automotive, and environmental applications.

One of the most significant opportunities lies in the healthcare and pharmaceutical sectors, where stringent requirements for sterile environments and contamination control are accelerating the adoption of ePTFE membrane filters. The global pharmaceutical filtration market is projected to grow steadily, with ePTFE membranes playing a critical role in ensuring product purity and process reliability. The COVID-19 pandemic has further underscored the importance of advanced filtration in medical devices and personal protective equipment, a trend expected to persist in the coming years MarketsandMarkets.

- Water and Wastewater Treatment: Increasing concerns over water quality and the tightening of environmental regulations are driving investments in advanced filtration technologies. ePTFE membranes, with their high permeability and fouling resistance, are being increasingly deployed in municipal and industrial water treatment plants, especially in regions facing water scarcity and pollution challenges Grand View Research.

- Electronics and Semiconductor Manufacturing: The demand for ultrapure water and cleanroom environments in semiconductor fabrication is fueling the use of ePTFE membrane filters. As the electronics industry continues to expand, particularly in Asia-Pacific, this segment is expected to offer substantial growth opportunities Fortune Business Insights.

- Air Filtration and Environmental Protection: With global air quality concerns and stricter emissions standards, ePTFE membranes are increasingly used in industrial air filtration systems, including baghouse filters for power plants and manufacturing facilities. Their durability and efficiency in capturing fine particulates make them a key component in pollution control strategies.

Looking ahead, ongoing R&D efforts aimed at enhancing membrane performance, reducing production costs, and expanding application areas are expected to further boost market growth. Strategic collaborations between membrane manufacturers and end-user industries, as well as the integration of smart monitoring technologies, will likely shape the competitive landscape and unlock new opportunities for ePTFE membrane filtration systems in 2025 and beyond.

Sources & References

- MarketsandMarkets

- Grand View Research

- Fortune Business Insights

- Research and Markets

- W. L. Gore & Associates

- Membrane World

- Frost & Sullivan

- Sartorius AG

- Mitsui Chemicals

- Pall Corporation

- IDTechEx